Supply chains are shutting down. Factories and offices are closing. Flights are being canceled, conferences postponed and soccer and rugby games rescheduled. It remains to be seen how much of a blow the spread of the coronavirus turns into for the global economy. But one thing is now certain: it is going to lead to a sharp slowdown. And the real question now is this: how should governments and central banks respond?

The medical response is already clear. Communities are put into lockdown. The infected are quarantined. Borders are closed where necessary. And treatment centers are braced for a vast increase in the number of patients. How well it works, and how quickly, remains to be seen. But at least a plan has been put in place.

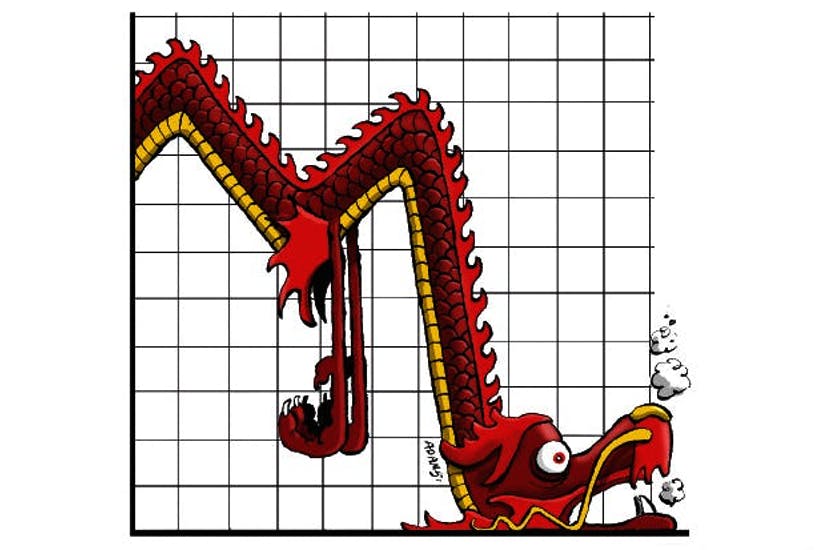

The economic response? Unfortunately that is far less clear. So far central bankers and finance ministers have said very little, apart from a few half-baked clichés about how there is nothing too much too worry about that. And yet, as the dramatic fall in the global equity markets of the last week have shown, output is about to take a big hit. In fact, governments should co-ordinate a coherent response right across the major economies — and that should have three parts.

First, they should reflate demand. A rate cut or two from the Federal Reserve is now certain. We can expect to see a fresh blast of quantitative easing (QE) over the next few weeks as well. But it will have go further than that. Hong Kong has already led the way with an extraordinary emergency budget that included giving a $1,300 payment to every citizen to keep people spending through a likely recession. If helicopter money — the economist’s term for simply printing cash and giving it to people — is needed, then this is the moment.

Next, boost government spending. There was already a consensus emerging that governments needed to spend more, in the UK for sure, and in Germany and the rest of the euro-zone even more so. This is the right moment to accelerate that. Healthcare systems are going to need massive extra funding to cope with all the extra work. Companies may need help to keep supply chains open if factories in China and elsewhere remain closed much longer. Borrowing was already cheap, and with the panic of the last week, it just got even cheaper. It would be crazy not to use that money to fight the crisis.

Finally, central banks need to support the financial system. When economies turn down, stresses always turn up somewhere. The insurers may well find themselves in trouble if they have not planned for a pandemic on this scale. Likewise the banks are unlikely to have stress-tested factory and office closures around the world and whole cities quarantined for weeks. If they are allowed to go bust, it will only escalate the crisis.

Of course, we may well see nothing. Or we may well see a series of half-hearted, un-co-ordinated measures, with a minor rate cut from the Federal Reserve followed by a slight increase in QE from the European Central Bank. But in truth, the slowdown in the global economy the coronavirus is now triggering demands a massive response — and that is what it should look like.

This article was originally published on The Spectator’s UK website.